This article aims to provide an overview of using options as a hedge against decentralized finance (DeFi) price risk. If you are unfamiliar with DeFi, do read our introductory article on DeFi before reading this article. You may also consider reading our articles on DYOR, DeFi risks, price risks, and DeFi risk framework before reading this article.

Price Risk and Derivatives

There are many ways to mitigate exposure to price risks, and one of the more common hedging strategies is through derivatives. Other solutions include effective portfolio diversification and adopting long-short strategies.

Derivatives are financial instruments that derive their price from underlying assets, making up one of the largest asset classes in the financial market. For example, the Bitcoin (BTC) perpetual futures contract derives its value from the spot BTC price. Many large corporations and institutional investors use derivatives to achieve their financial goals. For instance, large corporations may use futures contracts to hedge their price exposure to raw materials such as crude oil or corn, whereas institutional investors may deploy complex option structures to achieve their investment goals.

Read on to find out how you can effectively use options to hedge against price risk!

How Do Options Work?

Options grant holders the right to buy or sell an asset at a specific price by a certain date. There are two types of options, call and put. A call option grants the holder the right to buy, while the put option grants the holder the right to sell.

Options have expiration dates, and once they expire, the holder loses the right to “exercise” them. An option can be exercised only if it is “in-the-money” (ITM). For a call option, this refers to the underlying price being above the strike price. For a put option, ITM would refer to a situation where the underlying price is below the strike price. Strike price refers to the price at which the underlying asset can be bought or sold when the derivative contract is exercised. American Options can be exercised anytime, whereas European Options can only be exercised upon expiration.

Options command a premium that the buyer has to pay to the seller. Options premiums are determined by their intrinsic value, the difference between the strike and the spot price, and their extrinsic value, which is composed of different factors like time, volatility, and interest rates.

| Option Type | Call | Put |

| Right | Right to buy | Right to sell |

| Only can be exercised if… | Option is in-the-money | Option is in-the-money |

| In-the-money | Underlying Price > Strike Price | Strike Price > Underlying Price |

| Out-of-the-money | Strike Price > Underlying Price | Underlying Price > Strike Price |

| Does it expire? | Yes | Yes |

| American Options | Can be exercised at any time | Can be exercised at any time |

| European Options | Can be exercised only upon expiration | Can be exercised only upon expiration |

| Premium | Buyer of options pays the premium, which is determined by the option’s intrinsic and extrinsic value | Buyer of options pays the premium, which is determined by the option’s intrinsic and extrinsic value |

Here is an example of how a call option works:

- Bob purchased a BTC call option on 1 August 2022 with the following characteristics:

- Strike Price: $50K

- Expiration Date: 31 December 2022

- American Style Option

- When Bob purchased the option, the price of BTC was $30K

- On 25 December 2022, BTC’s price is at $60K

- Bob has the right to exercise the option, meaning he can now purchase BTC at $50K (strike price) instead of $60K, which is the current market price

- Theoretically, Bob makes a profit of $10K (excluding the premium paid for the option) when he immediately sells his BTC at the spot market price of $60K after exercising the call option to purchase BTC at $50K

The opposite is true for a put option:

- Bob purchased a BTC put option on 1 August 2022 with the following characteristics:

- Strike Price: $25K

- Expiration Date: 31 December 2022

- American Style Option

- When Bob purchased the option, the price of BTC was $30K

- On 25 December 2022, BTC’s price is at $10K

- Bob has the right to exercise the option, meaning he can now sell BTC at a price of $20K (strike price) instead of $10K, which is the current marketing price. Theoretically, Bob makes a profit of $10K (excluding the premium paid for the option) when he purchases BTC from the market at $10K and sells it at $20K immediately by exercising the put option

While the holder of an option has rights, the seller of an option has the obligation to take the opposite side of the trade if and when the owner exercises his right. This means that the buyer of the option can choose to exercise or not to exercise, while the seller of the option does not have a choice.

Using Options to Hedge Against Price Risk

Hedging requires having an inverse position in the hedged asset. If the hedged asset’s price moves against the investor, the inversely correlated position should move in the opposite direction, offsetting the losses incurred on the hedged asset.

For example, if an investor has a long position in BTC, the investor can buy a put option to protect themselves from a fall in BTC’s price. Vice versa, the investor can purchase a call option to hedge their short position in BTC. The strike price, expiration date, and quantity of contracts are all factors to consider when hedging with options.

Long position: Indicates that an investor owns an asset

Short position: Indicates that an investor sells an asset he does not own

Here is an example of how to hedge using options:

Bob has a total of 5 BTC in his portfolio. He plans to hedge his investments using options because he is concerned about the current state of the cryptocurrency markets. Here are Bob’s considerations:

- Type of Option Structure

- Expiration Date

- Number of Contracts; and

- Strike Price

Bob can buy puts to protect his portfolio since a put is an option contract that offers the holder the right to sell at a predetermined price. In this case, Bob needs to buy 5 put options contracts (assuming each contract covers 1 BTC) to hedge the 5 BTC in his portfolio fully. Bob must then decide on a strike price and expiration date.

Assuming BTC is currently trading at $30K and Bob predicts the price of BTC could go down to $25K, he opts for the $25K strike. Bob can exercise the right to sell BTC for $25K if BTC falls below $25K, regardless of the current market price of BTC. Finally, Bob buys the put option that expires in three months and has hedged his 5 BTC position at $25K. It is important to remember that many other aspects are at play, such as implied volatility and Greeks exposure, which are advanced topics for more experienced options traders. However, understanding the basics would suffice in hedging price risks.

The diagrams below illustrate how the hedges will work in relation to the case study on Bob.

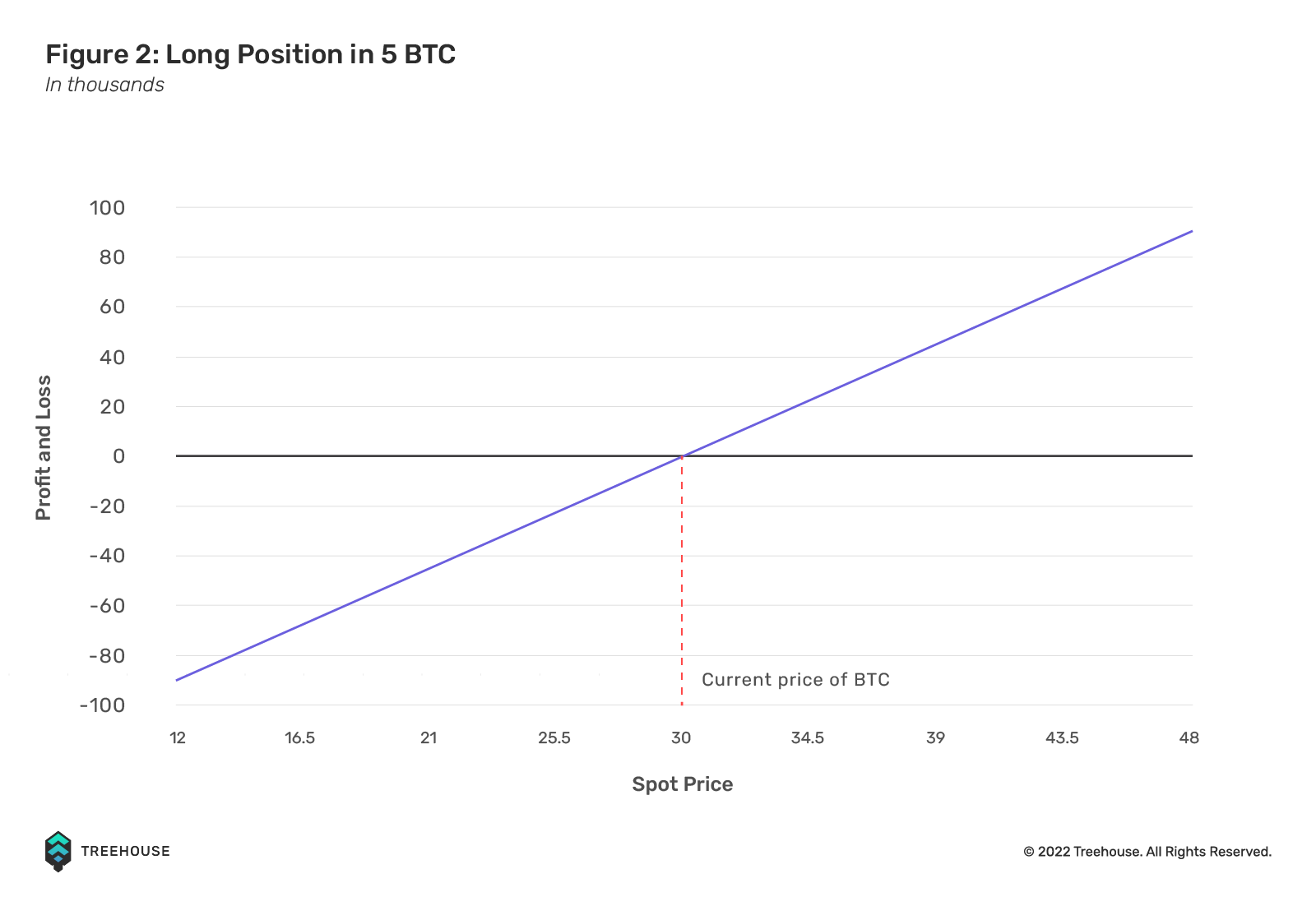

Figure 2 represents the payoff diagram of Bob’s portfolio which contains 5 BTC. This position does not consider any option position, but only the 5 BTC that Bob currently holds at $30K.

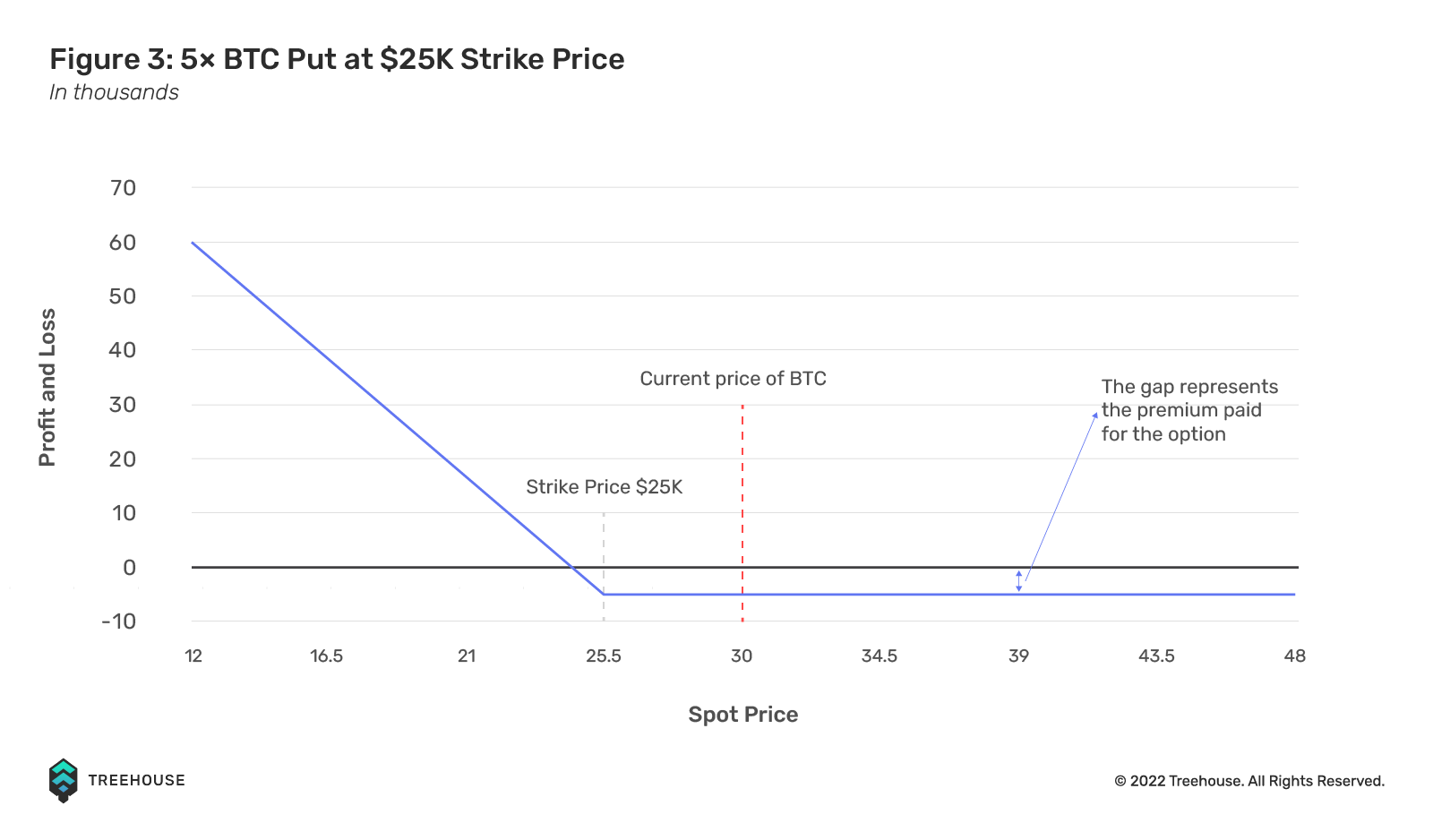

Figure 3 depicts the payoff structure for 5× put options on BTC. When the underlying BTC goes below the strike price of $25K, the put option earns value. When it rises over the strike price, it loses value. The option will expire worthless if BTC closes above $25K at the time of expiration. The overall loss in this situation would be equal to the premium paid for the option, as shown by the gap between the graph and the zero line.

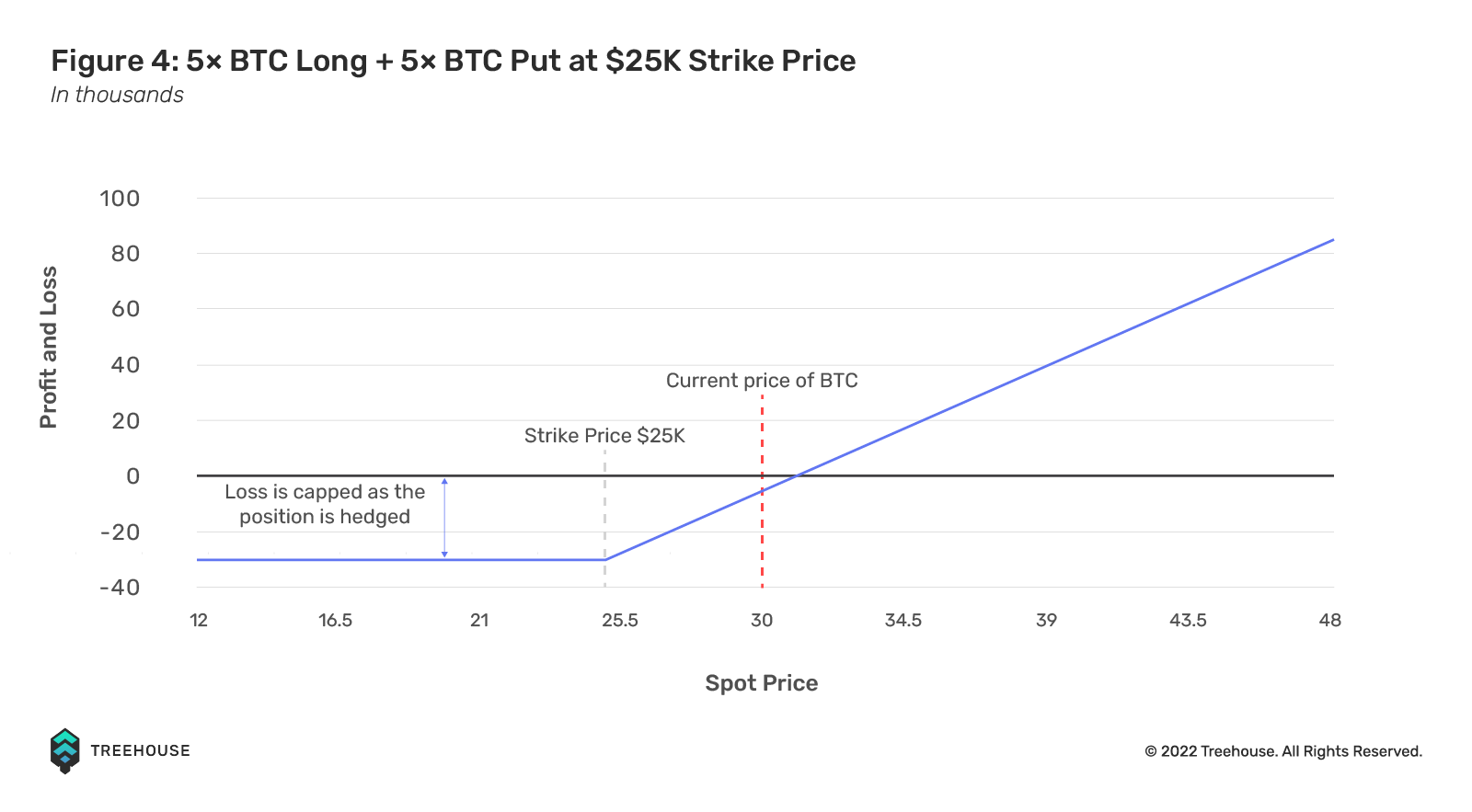

Figure 4 shows the payoff diagram for both the long underlying position and the put position. Combining both trades from figures 2 and 3 shows that Bob’s losses are capped even if BTC were to go below $25K. This is because the gain on the put option (Figure 3) offsets the loss in BTC’s spot decline (Figure 2). Overall, Bob can maintain positive delta exposure to BTC while capping his losses if BTC falls below $25K.

Options command a premium because they are insurance products. Users must keep track of the protection costs as they can get pricey, especially during volatile periods due to higher demand for puts. Aside from simply buying vanilla calls and puts, skilled investors can use complex structures to reduce hedging costs, such as spreads and risk reversals. Here are a few examples of hedging option structures:

List of option structures used for hedging:

| Hedge Long Underlying (Positive Deltas) | Hedge Short Underlying (Negative Deltas) |

| Buy Put | Buy Call |

| Sell Call | Sell Put |

| Put Spreads | Call Spreads |

| Call Ratios | Put Ratios |

| Short Risk Reversal | Long Risk Reversal |

Click here to find out more about the option structures in detail.

Where to Purchase Options?

Here are some well-known centralized exchanges that specialize in options trading:

| Exchange | Product |

| Deribit Exchange | BTC, ETH, SOL |

| Delta Exchange | BTC, ETH, SOL, XRP, AVAX, MATIC, BNB, LINK |

| Bit.com Exchange | BTC, ETH, BCH |

| OKX Exchange | BTC, ETH |

Note that each platform has its own KYC (know your customer) and margin requirements.

There has also been an increase in the number of protocols specializing in decentralized options. Decentralized options have a greater variety of underlying assets, and some protocols also help to automate the hedging process by creating option vaults strategies. Some noteworthy examples include Ribbon Finance, Thetanuts, and Zeta Markets.

The Future of DeFi With Options

Options can be used in various imaginative ways by investors to hedge their positions, ultimately distinguished by their flexibility and convexity in comparison to the spot market. Aside from hedging, the beauty of options is that they allow investors to express their directional views by engaging in a specific option structure while providing access to leverage.

Derivatives hold high importance in the more mature traditional finance (TradFi) markets, so the emerging derivatives sector in DeFi is no surprise. Many DeFi derivatives projects are still in their early developmental stages, where risk is hard to discern, but with greater user adoption and building by developers, there is much potential to be unleashed. If you are looking for some alpha, DeFi Options Vaults (DOVs) is one area to look out for. Read our Insights article, “DeFi Options Vaults: Options Democratized” to learn more!

At Treehouse, we want to empower people to confidently navigate DeFi, and this includes helping users understand and assess risk properly. In case you missed it, check out our recommended list of risk-related pieces!

- How to Make Sense of Metrics in DeFi

- The Truth About Audits in DeFi

- DeFi Risks: What You Need to Know

- How to Manage Your Defi Risks With This Framework

- Introducing Price Risk and Basic Trading Strategies

- Flash Loans and Flash Loan Attacks? What Are They and How to Prevent Them?

- A Look Back at Past Crypto Winters

- How to Measure Your Price Risk in DeFi

- Diversify Your Portfolio to Manage Your DeFi Price Risk

- How to Manage DeFi Price Risk by Setting Stop Losses

- How to Reduce DeFi Price With Delta Neutral Strategies

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.