2025 was a pivotal year for Treehouse

What began as a bold vision to build the fixed income layer for DeFi is now a live ecosystem of protocols, products, and partners powering benchmark rates, structured yield strategies, and tokenized interest rate primitives across chains.

Despite market volatility, the focus remained on scaling the decentralized fixed-income layer and aligning interests for users and token holders.

Here’s a look back at what we’ve built this year!

A Year of Breakthroughs

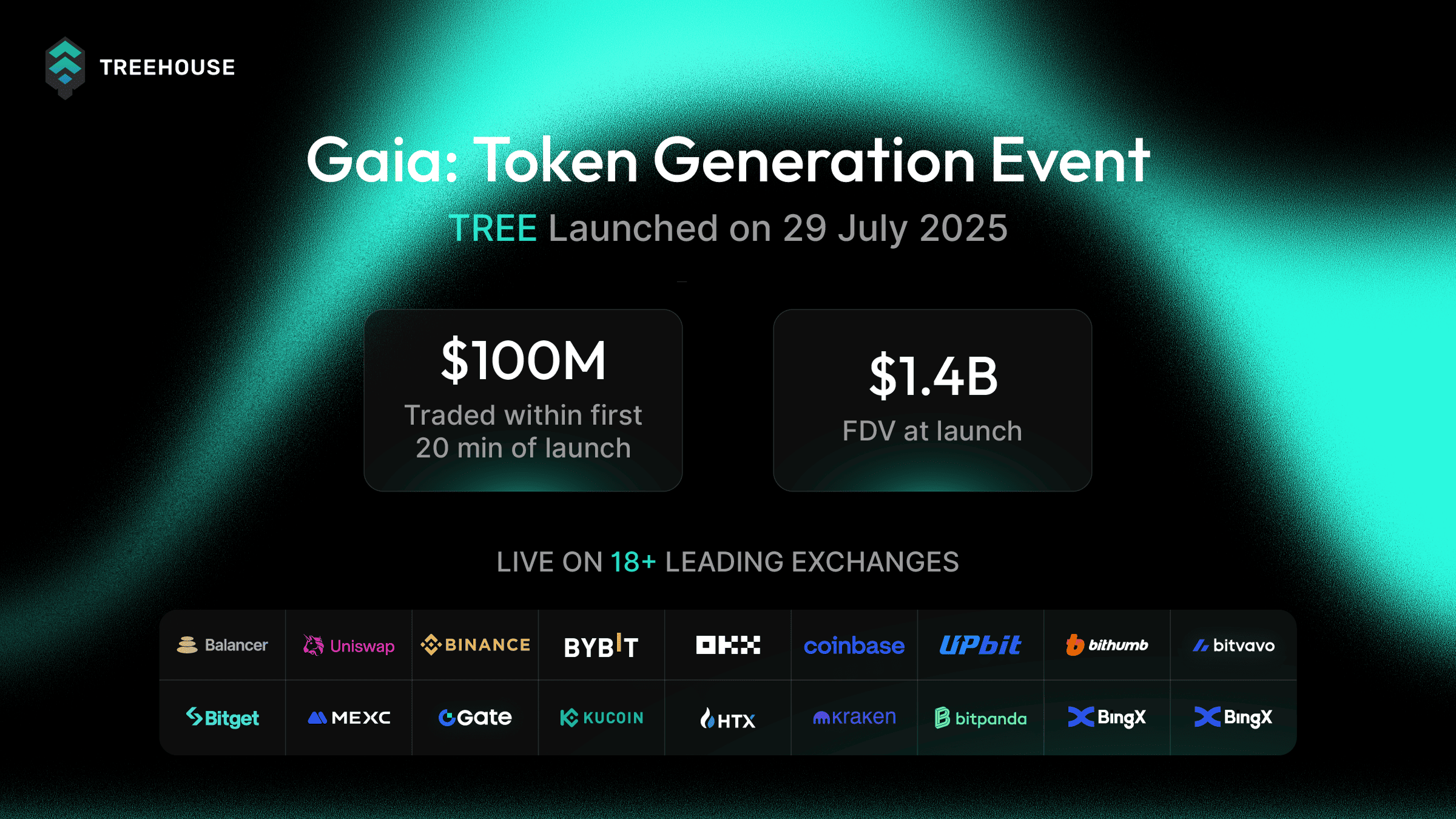

This year, we launched the TREE token through the Gaia Token Generation Event on July 29, 2025, marking a pivotal step in empowering community governance and utility within the Treehouse ecosystem. The response was overwhelming, trading volume soared past $100 million within the first 20 minutes of listings on major exchanges like Binance, Coinbase, OKX, Bybit, Upbit, and Bitget, while our Fully Diluted Valuation (FDV) peaked at $1.4 billion, reflecting immense market confidence and global accessibility from day one.

Treehouse further embraced decentralization by activating the Treehouse DAO, handing governance to TREE holders through Treehouse Improvement Proposals (TIPs). This enables the community to propose, debate, and vote on upgrades, ensuring Treehouse evolves as a transparent, decentralized financial layer.

Commitment to Sustainable Value

To support long-term ecosystem growth, we initiated revenue-backed token buybacks, aligning value accrual with platform growth. By redirecting revenue to TREE and bolstering token demand, we’re building a stable foundation that prioritizes innovation and resilience for all holders.

Product Milestones: tAssets

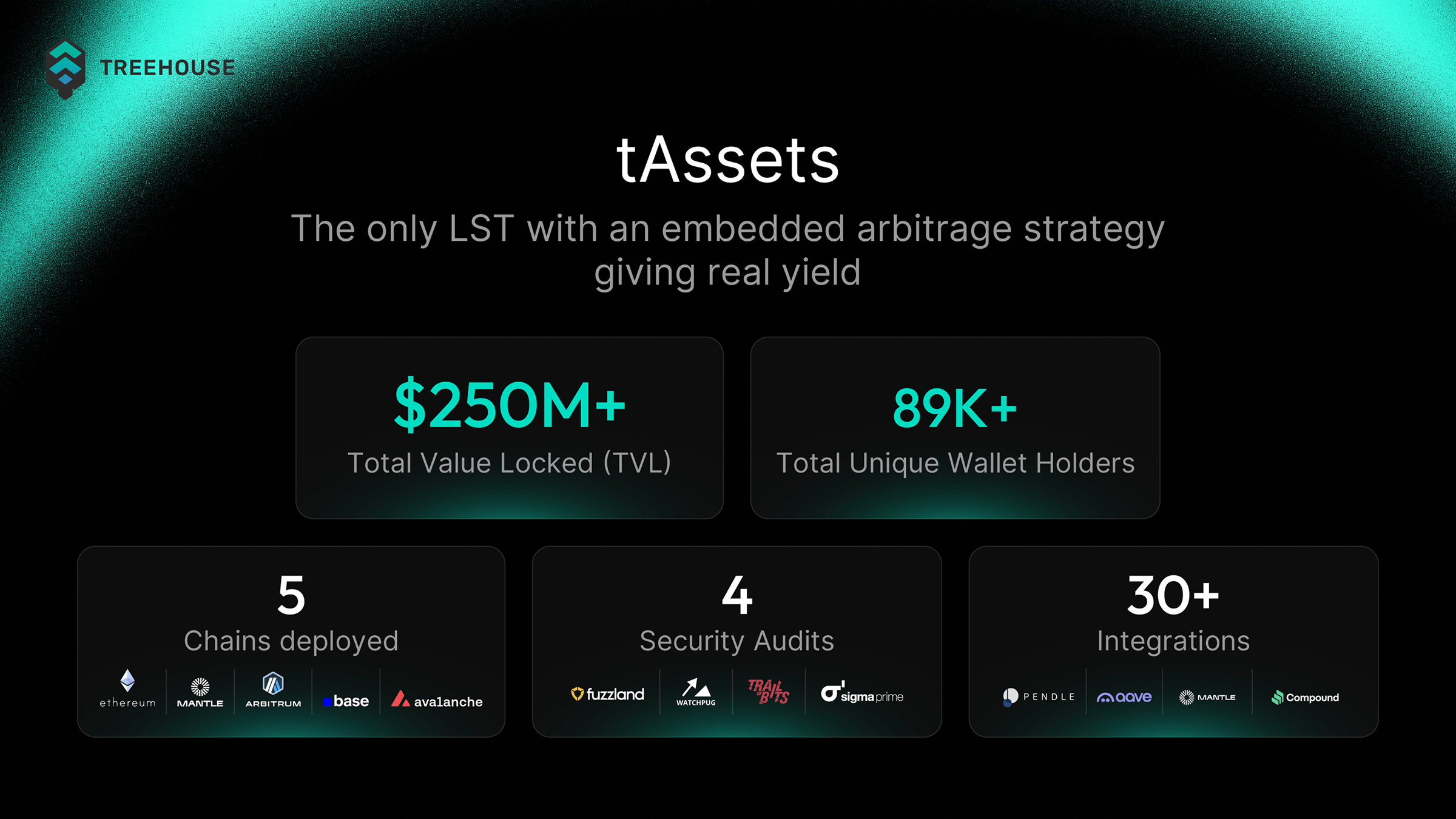

As of late 2025, Treehouse maintains over $250 million in Total Value Locked (TVL) and 89,300 unique holders. Following the multi-chain expansion strategy, flagship tAssets were deployed on Avalanche, Base, and Arbitrum to provide Market Efficiency Yield (MEY) across these networks.

The expansion resulted in the following network developments:

- Avalanche: Launched tAVAX to integrate yield-generating assets into the network’s institutional and DeFi ecosystem.

- Base & Arbitrum: Deployed tETH to provide Ethereum users with yield options characterized by lower transaction costs.

- Liquidity & Collateral: These expansions were designed to increase tETH liquidity and expand collateral options within the broader DeFi landscape.

This multi-chain approach is intended to create a unified fixed-income layer. By utilizing decentralized arbitrage to converge rates across fragmented liquidity pools, we aim to standardize yield consistency regardless of the underlying chain.

Strategic Alignments

In 2025, Treehouse significantly expanded its ecosystem through strategic partnerships and deep integrations, solidifying its position as the decentralized fixed income layer in DeFi. Key partnerships include:

- Aave, Compound, Euler, Silo, Folks Finance: Accepted tETH and tAVAX as supported collateral, enabling optimized lending and borrowing against fixed-income assets.

- Upshift, KelpDAO, Turtle: Formed core partnerships to launch enhanced yield strategies and drive institutional adoption of decentralized benchmarks.

- CoW Swap: Provided MEV-protected, intent-based trading to give users the best possible rates when entering or exiting tAsset positions.

- Gearbox: Empowered users with advanced “looping” and leverage primitives to maximize capital efficiency on tAsset positions.

- Pendle, Spectra: Enabled yield-trading and yield-stripping for tAssets, allowing users to hedge or speculate on future fixed-income rates.

- Benqi, Term Finance: Supported the strategic expansion into the Avalanche ecosystem via tAVAX and the launch of structured fixed-income products.

Institutional-Grade Security

IIn 2025, we had over 11 smart contract audits conducted by leading security firms, including Trail of Bits, Sigma Prime, WatchPug, and Fuzzland. These audits covered critical components such as tETH vaults, the DOR consensus mechanism & cross-chain expansions (e.g., tAVAX).

Additionally, ongoing security monitoring is also supported by a bug bounty program on Hackenproof. Since April 2025, this program has offered a maximum reward of $250,000 for the reporting of protocol vulnerabilities.

As our TVL and holder base continue to grow, we remain fully committed to upholding the highest standards of security across the Treehouse ecosystem.

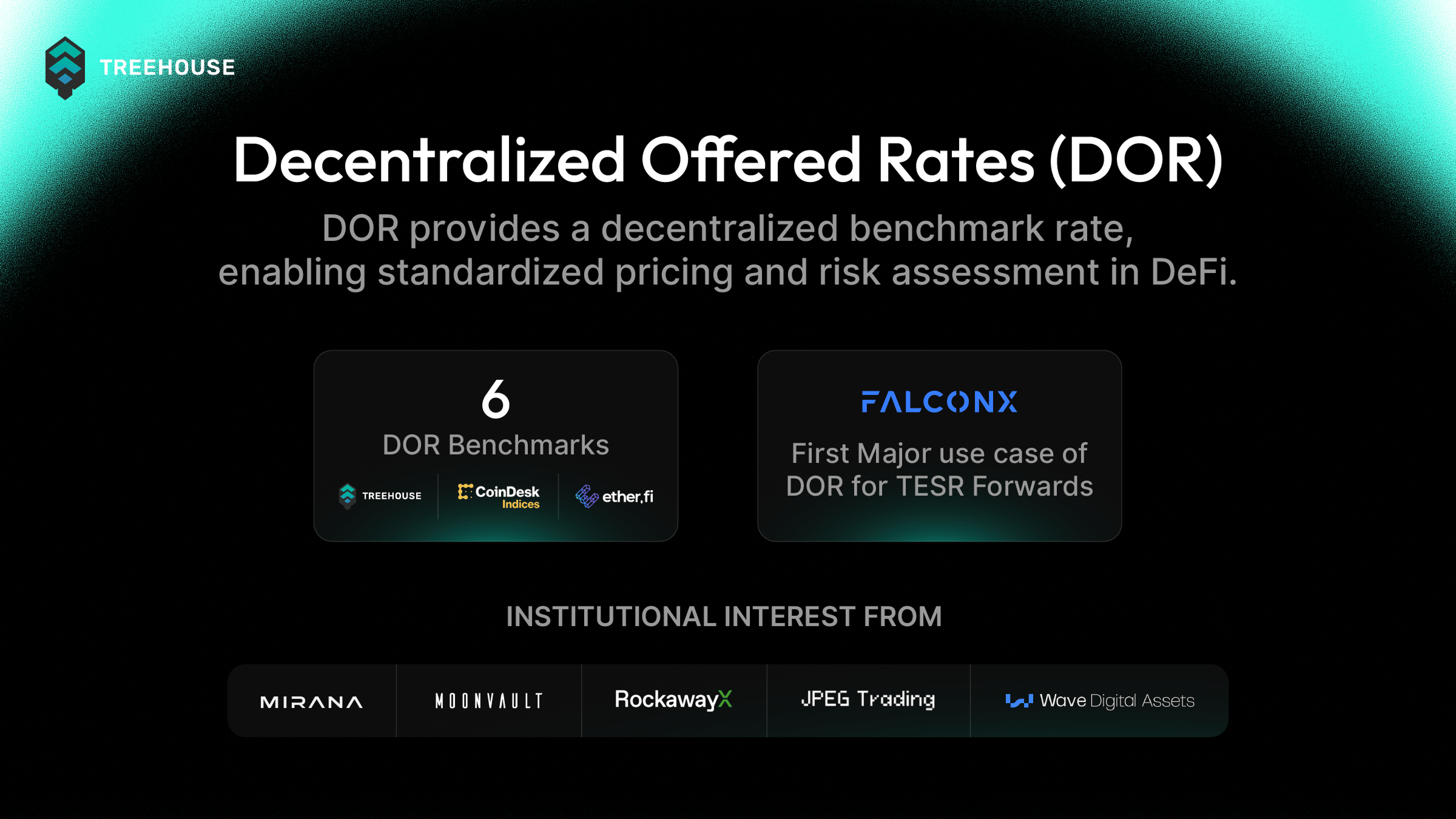

Product Milestones: Decentralized Offered Rates (DOR)

Another major milestone was the full mainnet launch of Decentralized Offered Rates (DOR) in July 2025, coinciding with the TREE token generation event. DOR, a consensus-driven mechanism inspired by traditional benchmarks like LIBOR/SOFR, establishes transparent, decentralized reference rates for on-chain yields. The flagship rate, Treehouse Ethereum Staking Rate (TESR), became a reliable daily benchmark for Ethereum staking yields, enabling structured products by unifying fragmented DeFi rates.

Learn more about DOR on Treehouse’s website, explore the official documentation, and view the latest published benchmark rates.

Building on this foundation, a suite of tradable Forward Rate Agreements (FRAs) for Ethereum staking was launched in partnership with FalconX. Utilizing TESR as the reference rate, these FRAs provide institutional users with instruments to hedge against yield fluctuations and manage return predictability. The introduction of interest rate forwards to the digital asset space facilitates deeper liquidity and indicates the further maturation of on-chain fixed-income markets.

A primary application of this infrastructure is seen in the recent integration with Term Finance, where participants utilize Treehouse Ethereum Lending Rate (TELR) and Treehouse Ethereum Borrowing Rate (TEBR) to structure lending offers and guide borrowing bids. By providing transparency through verifiable on-chain benchmarks, this framework enables precise and reliable market participation for all users.

Building a Thriving Community

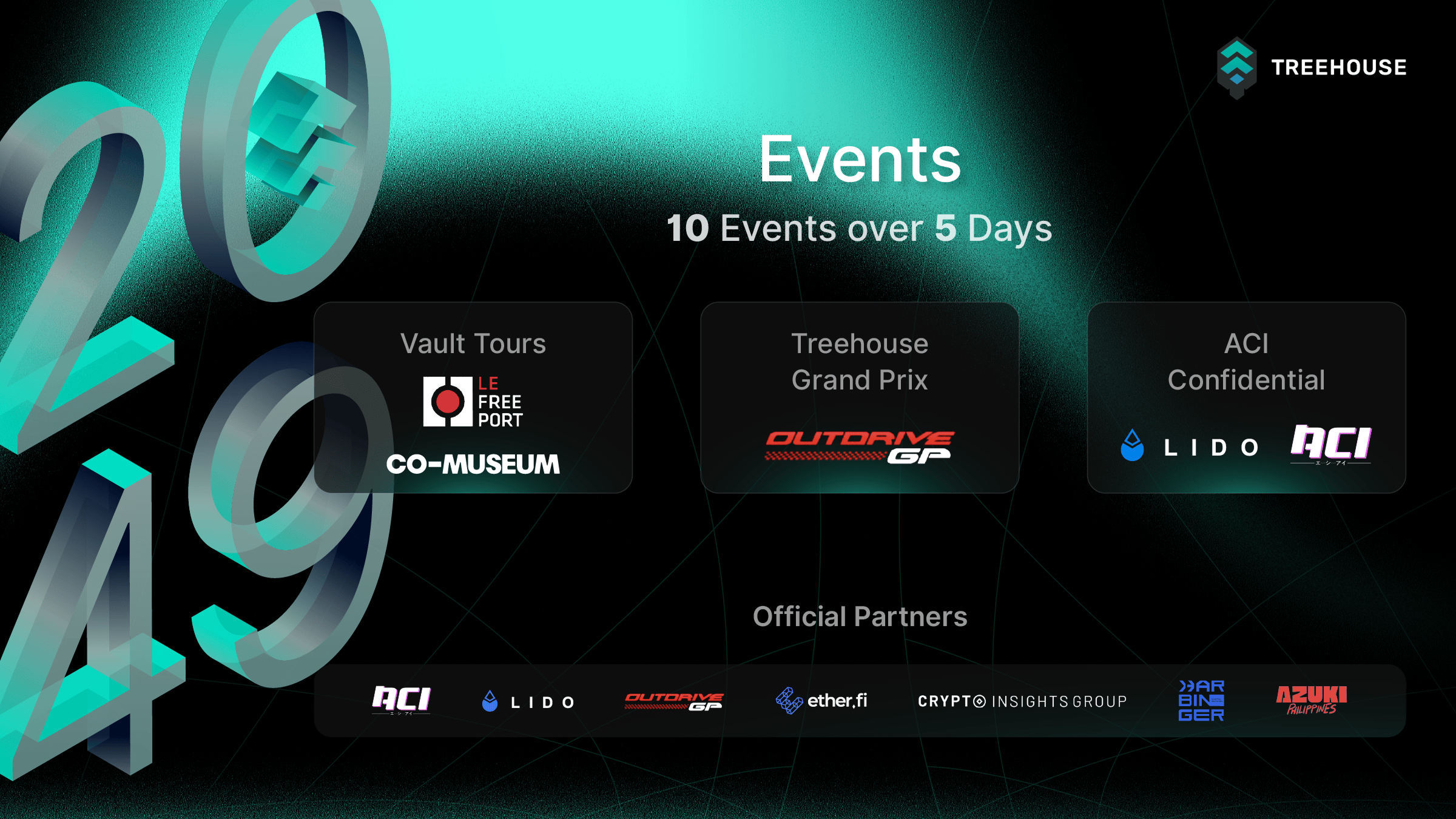

Our community engagement reached new heights this year through standout events during Token2049 such as Vault Tours and the Treehouse Grand Prix, organized with partners such as Le Freeport, Co-Museum and Outdrive. These connected us with thousands of attendees globally.

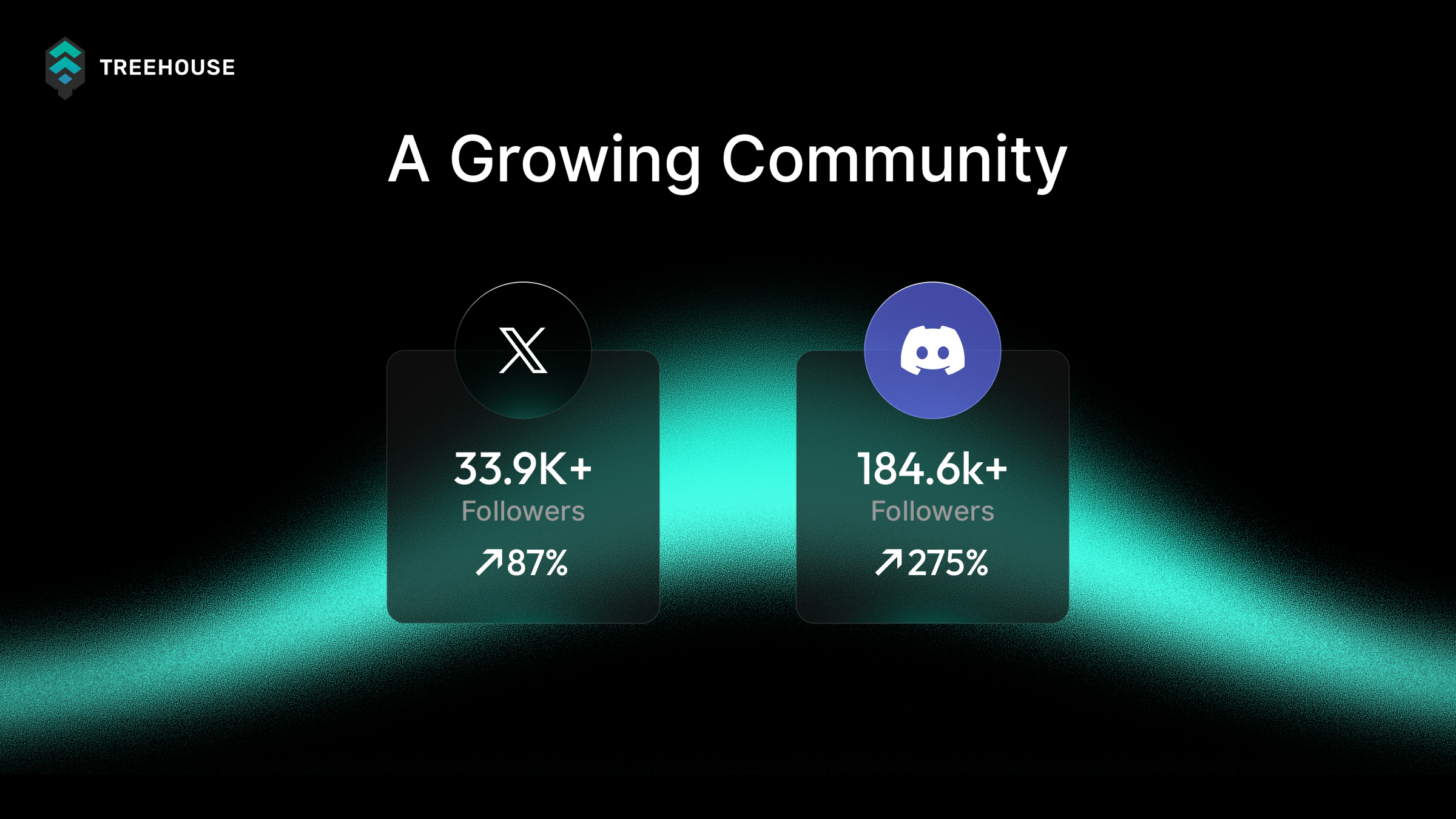

This commitment to transparency has fueled our growth, with Treehouse now boasting 184.6K+ followers on X and a vibrant Discord community of over 33,000 members.

Looking Ahead

While 2025 represented a significant period of growth and development, these milestones serve as the foundation for the next phase of the roadmap. The upcoming year will focus on strategic ecosystem expansion and the further maturation of decentralized fixed income infrastructure.

Everything we’ve built this year is a result of the work put in by our partners and the community. This shared effort is what makes Treehouse possible, and it’s the same energy we’re bringing into 2026.

Thank you!

About Treehouse 🌳

Treehouse, a digital assets infrastructure firm and the decentralized arm of the parent company Treehouse Labs, is at the forefront of revolutionizing the decentralized fixed income market. Treehouse Protocol introduces innovative fixed income products and primitives, starting with its first tAsset, tETH, a liquid staking token that empowers its users to participate in the convergence of on-chain Ethereum interest rates while retaining the flexibility to engage in DeFi activities.

Treehouse Protocol is also pioneering the Decentralized Offered Rates (DOR) consensus mechanism for benchmark rate setting, enabling a range of fixed income products and primitives into digital assets. Treehouse is dedicated to creating safer and more predictable return alternatives for both individual investors and institutions.

- Website: https://treehouse.finance

- X: https://x.com/TreehouseFi

- Discord: https://discord.gg/treehousefi