As tETH celebrates its first anniversary, we look back on a year that validated our core mission—to deliver consistent, low-volatility returns while protecting user capital through all market conditions.

Over the past twelve months, tETH has grown steadily into one of the most trusted assets in the liquid staking landscape.

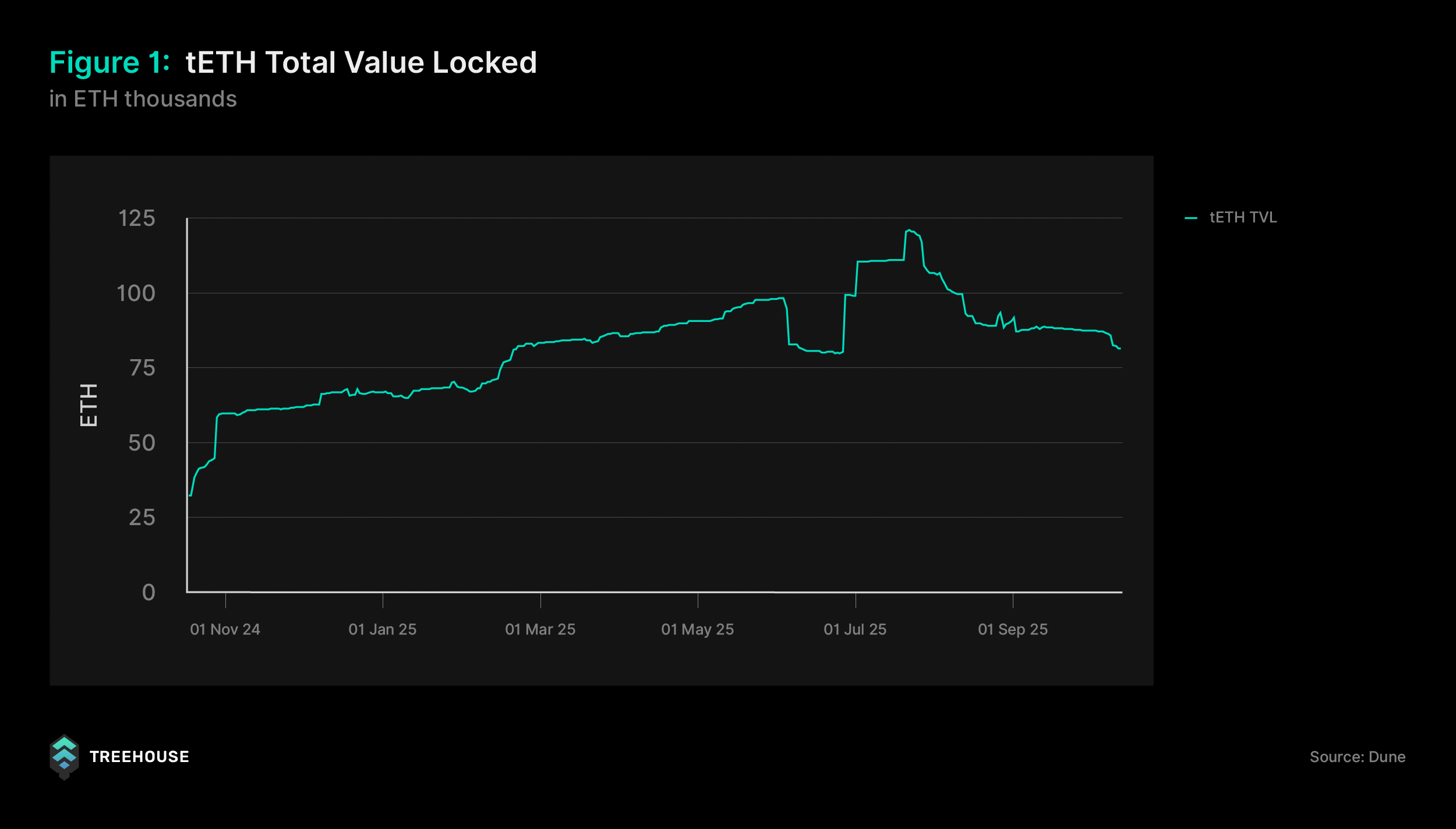

Since launching in October 2024, it has surpassed 81,000 ETH (approximately $300 million) in total value locked, and over 47,000 users, reflecting strong and sustained adoption from both retail users and institutional participants.

Beyond growth, tETH has achieved what it set out to do.

Over the past year, it generated an effective staking yield of 3.43%, outperforming stETH’s 2.95% over the same period. This edge highlights tETH’s ability to capture yield from market inefficiencies while maintaining a disciplined focus on risk management and capital preservation.

In this review, we highlight the key milestones that shaped tETH’s first year, analyze its risk-adjusted performance, and examine how the strategy held firm through major market events.

Investment Approach

tETH’s investment strategy is guided by two core principles: protect capital and generate consistent, compounding returns. These goals are achieved through two complementary mechanisms that work together to deliver stable yield with minimal volatility.

1. Staked ETH Carry Trade

At the core of tETH lies an interest rate arbitrage strategy, often referred to as a “carry trade.”

The process captures the yield spread between staking rewards and on-chain borrowing costs.

Specifically, we capitalize on fragmented rates by:

- Earning the Staked ETH Yield, considered as Ethereum’s foundational ‘risk-free’ rate.

- Borrowing ETH on lending platforms when the cost of borrowing ETH is lower than the ETH staking yield.

The difference between these two rates forms the Market Efficiency Yield (MEY)—the additional return that tETH generates by capturing inefficiencies in the market.

As long as the spread remains positive (Staked Yield > Borrow Cost), tETH continues to accrue this excess yield.

This strategy enables users to benefit from stable returns without the need for over leveraging or complex trading strategies.

2. Venue Optimization

To maintain consistent performance, tETH continuously optimizes where capital is deployed. This involves expanding the tETH strategy across multiple venues and shifting allocations to where borrowing conditions are most favorable.

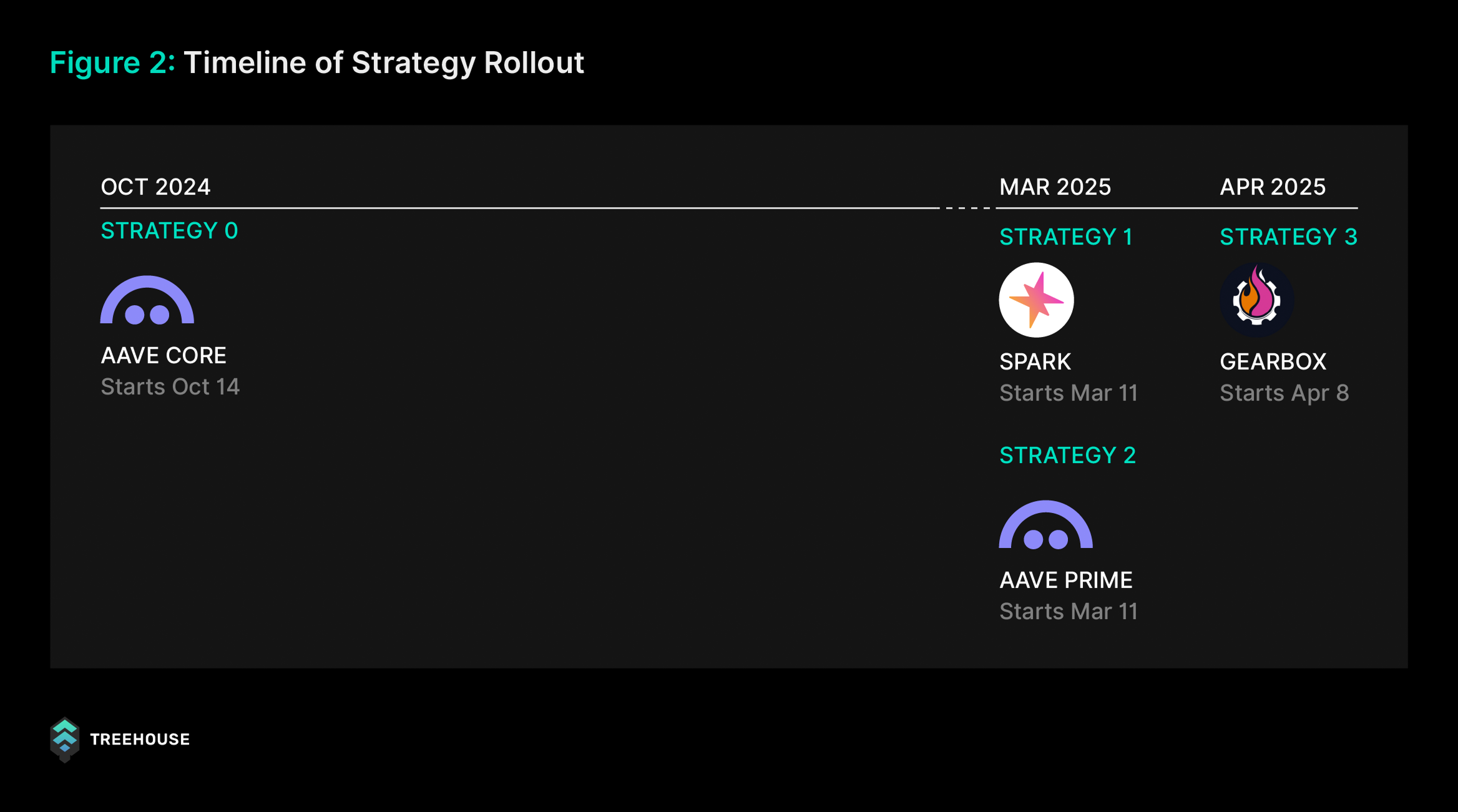

The strategy rollout occurred in phases:

- 14 October 2024: Strategy 0 launched on Aave Core

- 11 March 2025: Strategy 1 on Spark and Strategy 2 on Aave Prime

- 8 April 2025: Strategy 3 on Gearbox

This multi-venue approach gives tETH the flexibility to reallocate capital across platforms, capitalize on underutilized opportunities, and minimize reliance on any single source, while avoiding overutilized pools.

The objective remains the same: to sustain steady MEY without taking unnecessary risks. Looking ahead, Treehouse plans to expand this framework further, enhancing yield efficiency for our users.

Performance Overview

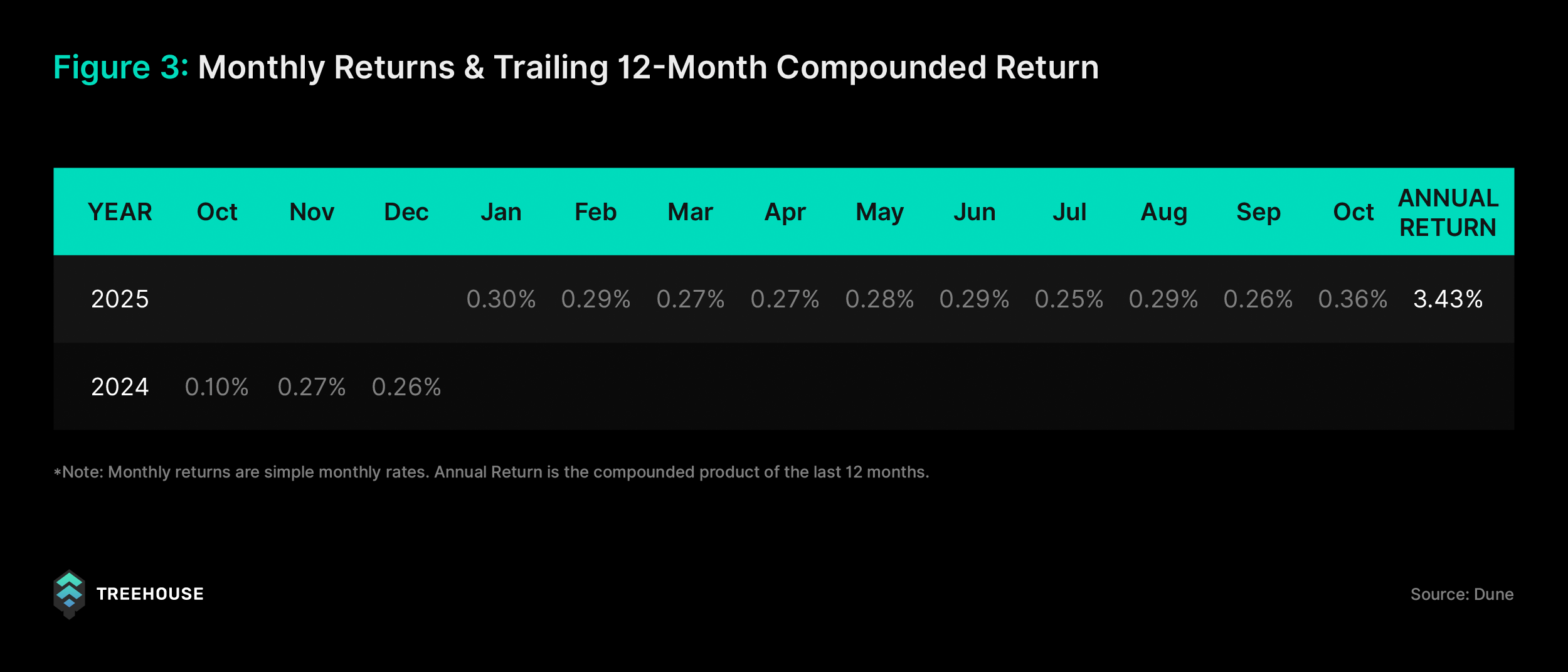

tETH’s diversified strategy has been the foundation of its consistency. Over the past year, monthly net returns have stayed within a narrow band of 0.26% to 0.30%, indicating high predictability and control in performance.

Quiet Outperformance

To put tETH’s consistency into perspective, its performance over the past year has quietly outpaced the broader liquid restaking (LRT) market. An equal-weighted index of major LRTs recorded a 3.18% return, while tETH achieved 3.43% over the same period.

In the early months, tETH’s returns were more measured, briefly trailing the index as it prioritized capital stability. A turning point emerged around June 2025, when borrowing conditions across key lending platforms began to ease. Average WETH borrow rates on Aave Prime declined from 2.85% in May to 2.54% in June, while Spark experienced similar improvements.

This reduction in borrowing costs increased tETH’s net carry, allowing its performance curve to steepen relative to the index. The gap that gradually widened through the late summer of 2025 serves as clear evidence of tETH’s quiet but steady outperformance.

Risk-Adjusted Efficiency

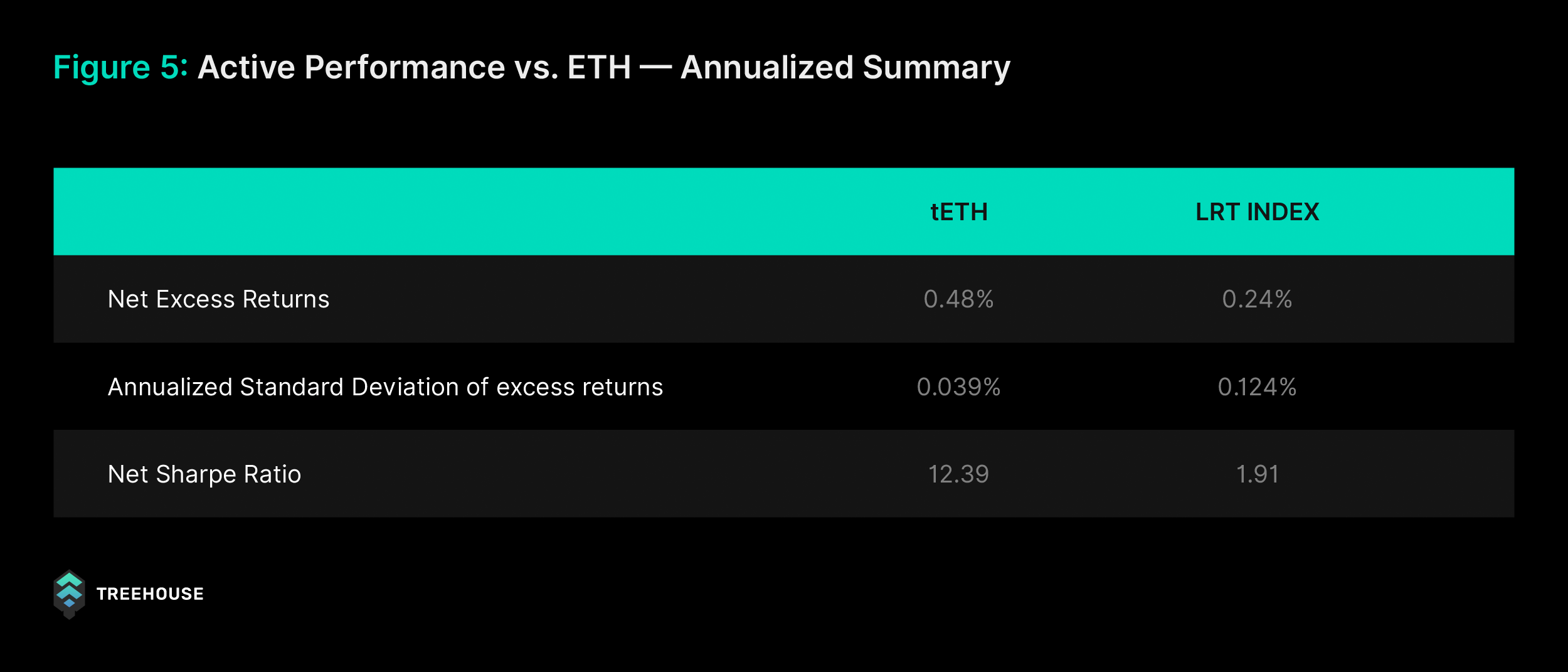

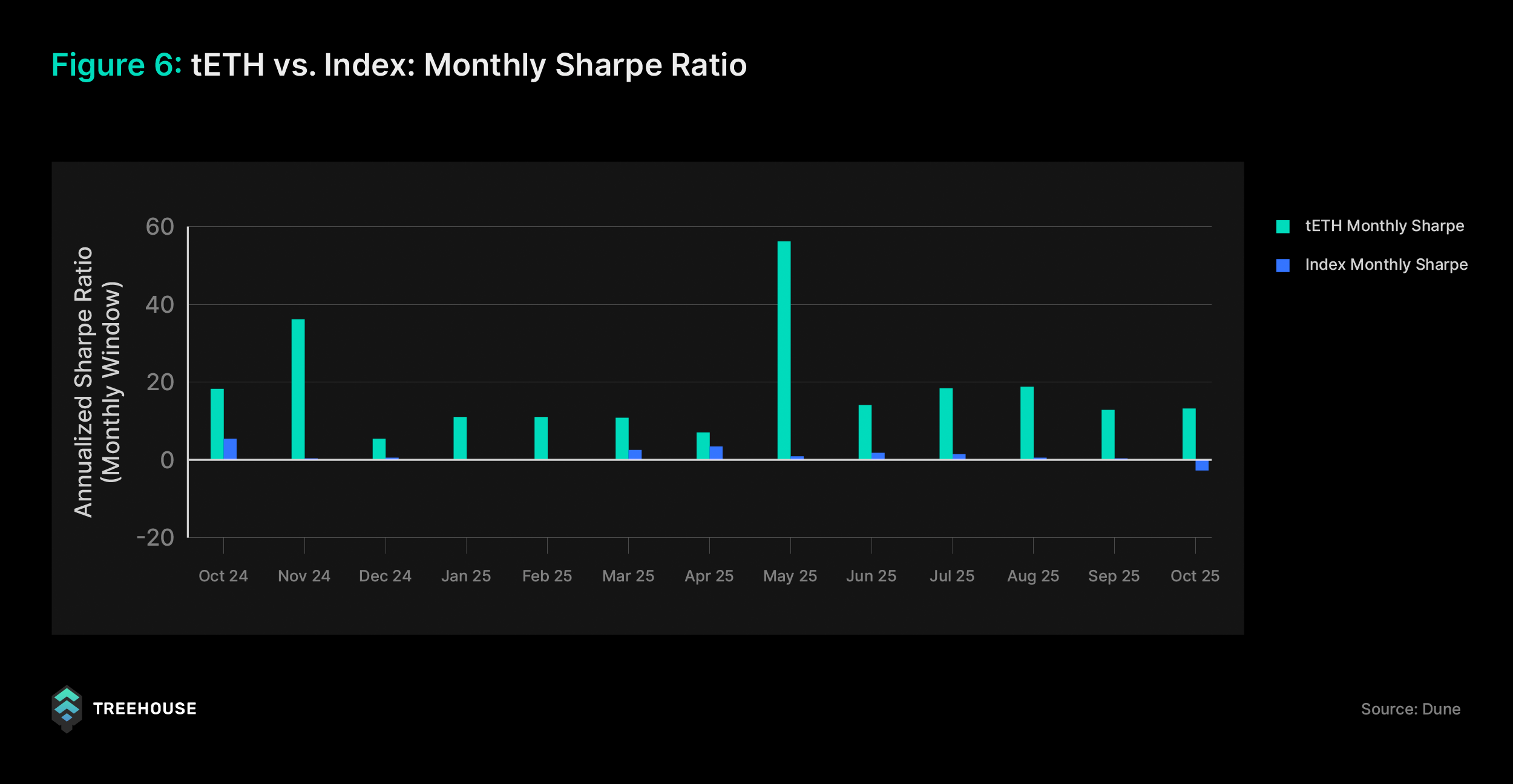

An equally important question is how efficiently tETH achieved its outperformance. This can be measured using the Sharpe ratio, which evaluates excess returns relative to volatility. For this analysis, Lido’s stETH yield served as the baseline benchmark for both tETH and the LRT Index, representing the standard “risk-free” rate within the liquid staking ecosystem.

Between October 2024 and October 2025, tETH generated double the net excess return of the LRT Index (0.48% vs. 0.24%) while maintaining significantly lower volatility. Its annualized standard deviation was approximately one-third that of the Index (0.039% vs. 0.124%). As a result, tETH achieved a Sharpe ratio of 12.39, compared to just 1.91 for the Index.

This outperformance was not driven by a few exceptional months. A review of monthly data confirms that tETH maintained a positive 30-day Sharpe ratio throughout the entire period, consistently outperforming the broader LRT market.

tETH’s risk-adjusted returns stayed in the double-digit range for most of 2025, with the only exception being December 2024. The strategy reached a peak in May 2025, recording a Sharpe ratio of 56.38, before stabilizing at elevated levels through the remainder of the year.

In contrast, the LRT Index’s risk-adjusted performance hovered near zero for most of the same period. Its best months produced only modest positive readings, such as 2.38 in March and 3.25 in April, before slipping into negative territory by October 2025 at -2.69.

Consistent MEY and Downside Control

The stability of tETH’s Market Efficiency Yield (MEY) is best reflected in its daily performance. Over the past year, tETH delivered positive returns on 339 out of 365 days, a success rate of approximately 92%. Periods of negative yield were rare, limited to just 26 days, and each drawdown was shallow and short-lived, typically recovering within one or two trading sessions.

This consistency highlights the strength of tETH’s yield-capture mechanism and its ability to sustain steady performance even as market conditions fluctuate.

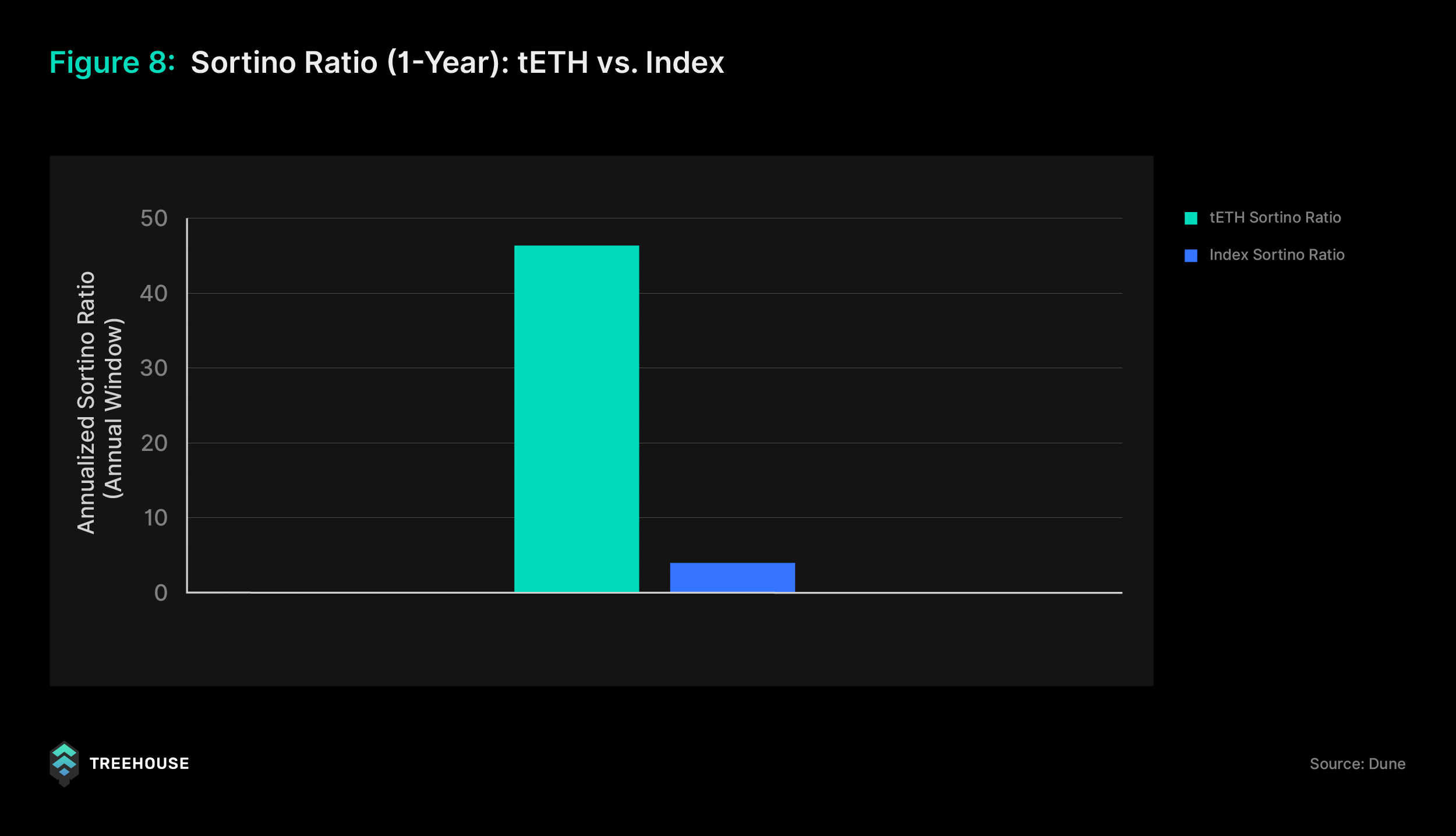

Sortino Ratio

This strong management of downside volatility is precisely what the Sortino ratio is able to capture. Put simply, the Sortino ratio measures how much an asset returns for each unit of downside risk, whereas the more common Sharpe ratio penalizes all volatility.

tETH’s strong management of downside risk is highlighted by its exceptional Sortino ratio of 46.53. This score, based on daily data, reflects its minimal and infrequent negative price movements. In comparison, the LRT Index recorded a much lower ratio of 3.93, as its more frequent drawdowns reduced overall risk-adjusted efficiency.

This result underscores tETH’s alignment with the objectives of allocators who value stability, capital protection, and steady excess yield relative to the broader stETH staking market.

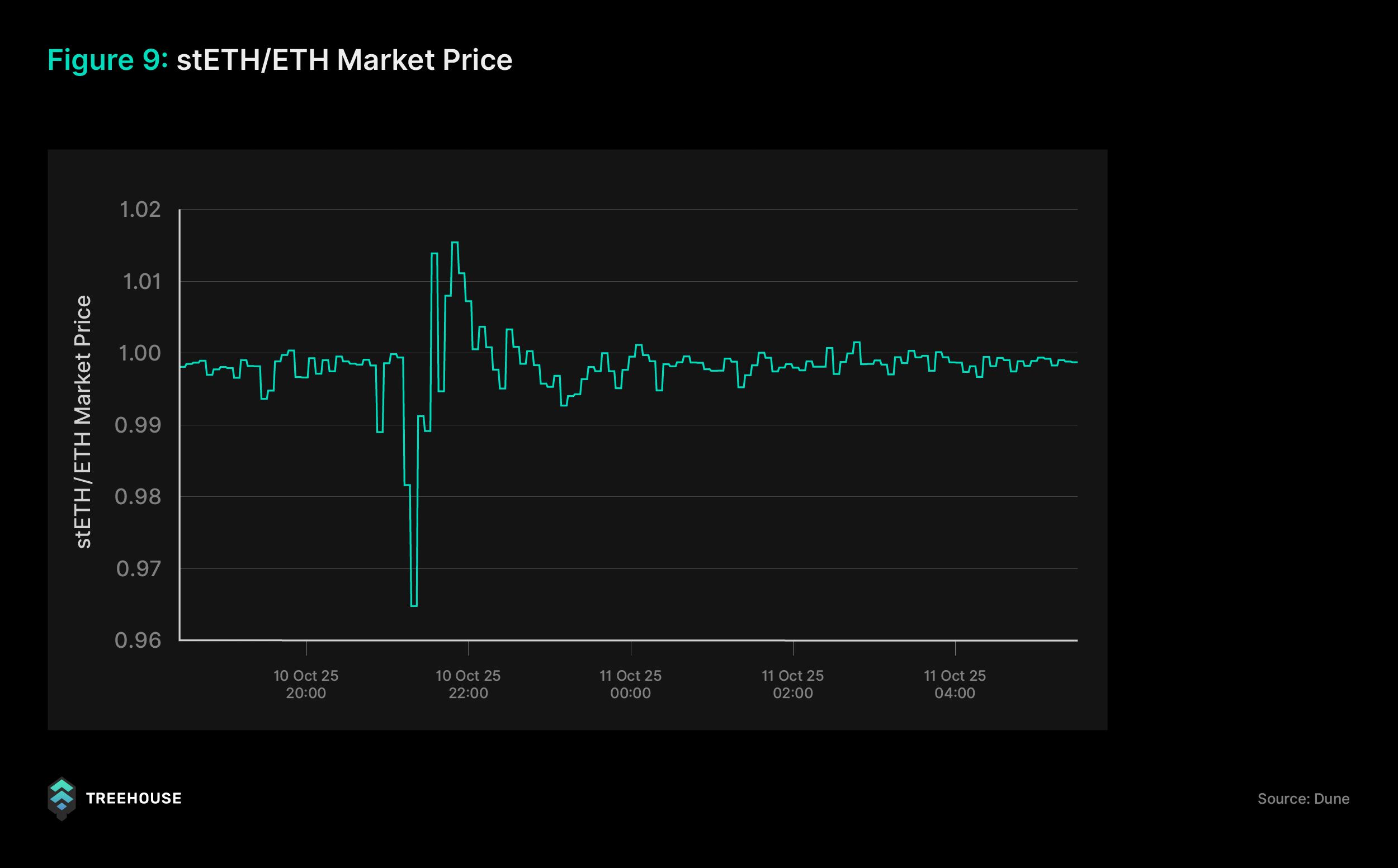

tETH’s Resilience During the October Flash Crash

On 10 October 2025, global markets experienced one of the sharpest intraday sell-offs of the year following President Trump’s announcement of new tariffs on Chinese imports. Around 21:00 UTC, liquidity across the crypto market thinned rapidly, triggering a broad risk-off event.

Within just 30 minutes, Ethereum fell by nearly 20%, while several other assets declined by 50–60%. CEXs and lending platforms such as Aave recorded heavy liquidations, with more than $180 million cleared during the event.

This event highlighted one of tETH’s most important safety features: its strategies are largely insulated from short-term market price movements.

During the crash, the stETH/ETH market price fell sharply to a low of 0.965, reflecting temporary dislocation across exchanges. However, this had no impact on tETH’s risk exposure.

The lending platforms powering tETH’s strategies, such as Aave and Spark, do not use that volatile market price to value collateral.

Instead, these platforms rely on on-chain oracles that track wstETH’s intrinsic value—a measure derived directly from Lido’s smart contract exchange rate. This rate represents the true value of wstETH based on accumulated staking rewards, rather than short-term trading sentiment.

Because of this design, the market panic that pushed stETH temporarily below parity had no direct effect on the valuation of our collateral. Throughout the event, tETH’s health ratios remained stable, holding around 1.58 on Aave Core and 1.18 on Spark.

Performance and Returns

tETH’s stability during the event also translated into steady performance. In the week leading up to the flash crash, daily MEY remained consistent, delivering annualized yields between 0.5% and 1.0%.

Even on the day of the crash, the strategy continued to perform as designed, recording a positive 0.63% MEY. By 11 October, as market volatility drove on-chain borrow rates lower, tETH captured the resulting inefficiency and achieved a 4.38% annualized MEY for the day.

As conditions normalized and utilization recovered, a brief two-day retracement occurred between 13–14 October, resulting in minor negative yields. However, recovery was swift. From 15–18 October, the strategy returned to stable performance, once again generating 0.5% to 1.3% annualized yields.

The flash crash served as a valuable real-world stress test, demonstrating that tETH’s strategy not only remains resilient during extreme volatility but also effectively capitalizes on the opportunities such events create.

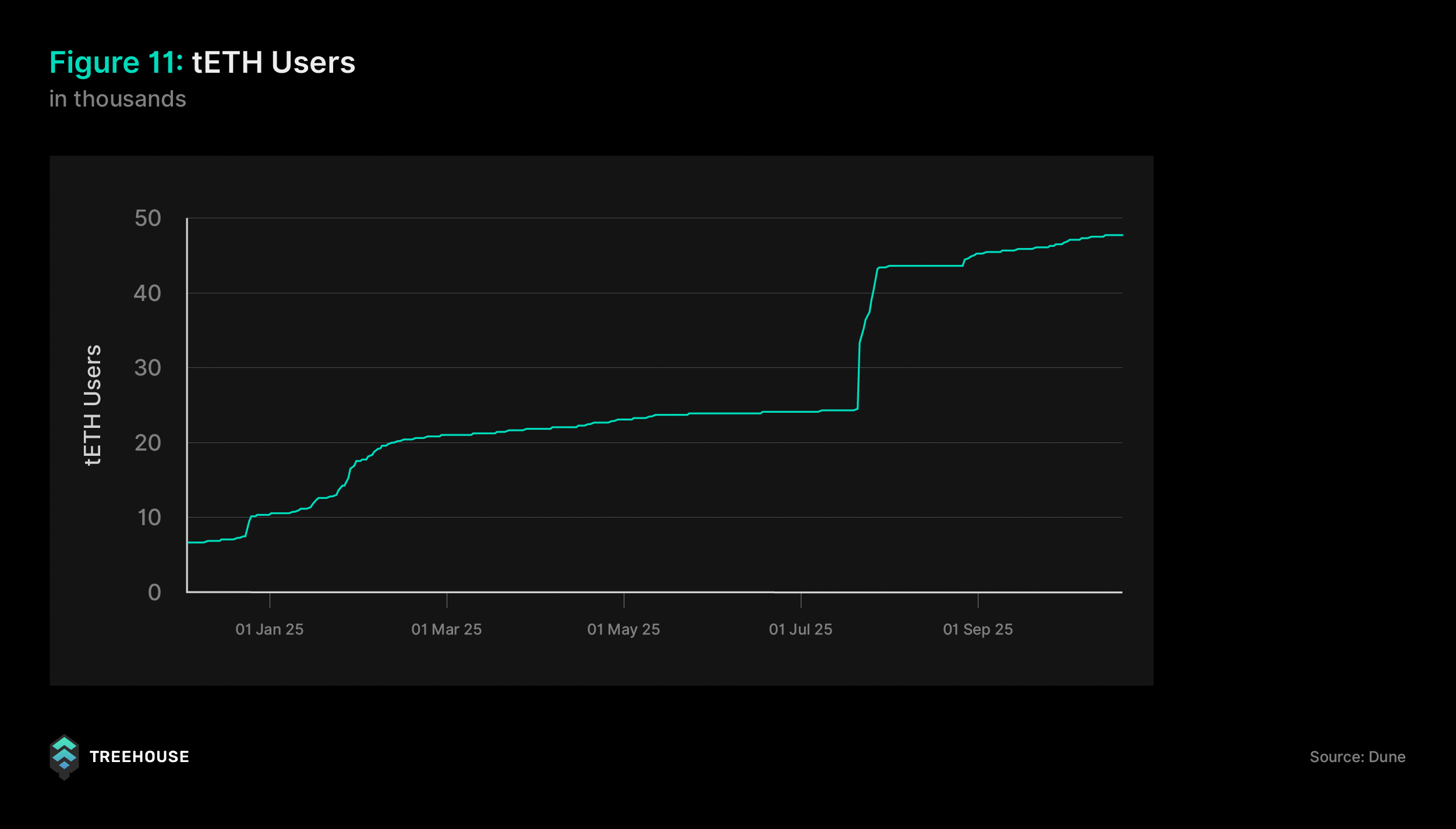

User Adoption and Network Growth

Beyond returns, tETH has seen remarkable user growth, expanding its total user base to over 47,000 participants. This figure includes holders on both Ethereum and Arbitrum, as well as participants across ecosystem products such as tETH LPs, Pendle LPs, PT-tETH, and YT-tETH.

As of this report on October 18th, 2025, tETH’s total user base has grown by 89% over the past 30 days, reflecting strong and accelerating adoption across the Treehouse ecosystem.

A major catalyst behind this growth was the Binance Booster campaign launched on 22 July 2025, which brought a significant influx of new users into the ecosystem. Importantly, most of these users have remained active within our ecosystem, signaling strong retention and lasting interest.

This continued growth has been further supported by inflows from participants in GoNuts Season 2, which began on 29 May 2025. The program strengthened engagement through reward-based activities, reinforcing tETH’s position at the center of a growing, multi-chain community of yield participants.

Key tETH Partnerships

Throughout the past year, Treehouse has expanded the tETH ecosystem through integrations and collaborations across major DeFi protocols and networks. These partnerships strengthen tETH’s liquidity, accessibility, and utility across multiple markets.

Money Markets

Aave (Prime and Core), Compound, Euler, Gearbox, Maple, Term, TermMax, and Silo

DEX and Liquidity Platforms

Balancer and Curve

Yield and Rate Markets

Pendle, Equilibria, StakeDAO, and Penpie

Vaults

ether.fi, Turtle Club, and Upshift’s gtETH Vault

Supported Chains

Ethereum, Arbitrum, TAC, and Base

These integrations have established tETH as a high-quality, yield-bearing collateral asset across multiple DeFi layers. They also expand opportunities for users to deploy, trade, and leverage tETH across both established and emerging ecosystems.

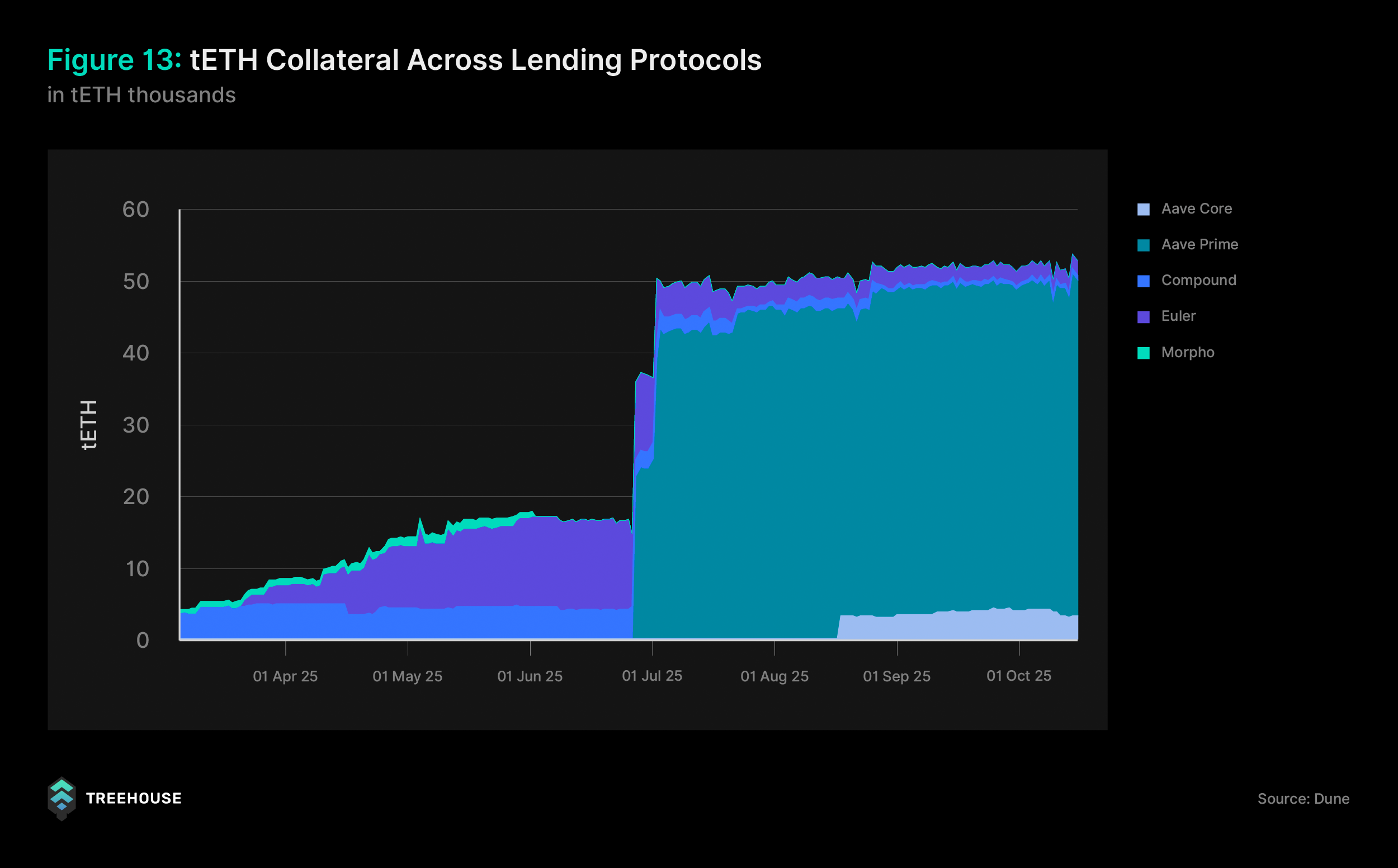

tETH Utilization

A strong indicator of tETH’s market acceptance is its growing use as high-quality collateral across leading lending platforms. Currently, approximately 42,000 tETH, valued at over $210 million, is posted as collateral, representing more than half of tETH’s circulating supply.

The majority of this activity is concentrated on Aave Prime, where tETH has become a preferred asset for users employing leveraged looping strategies to amplify staking exposure while maintaining stable, predictable returns.

This widespread adoption underscores market confidence in tETH’s design, its consistent performance record, and its growing role as a core yield asset within the DeFi ecosystem.

Conclusion

Over the past year, tETH has proven its ability to deliver consistent, low-volatility returns while scaling across both institutional and retail markets. Its underlying strategy, capturing the Market Efficiency Yield (MEY) between ETH staking and on-chain borrowing rates—has met its core objectives of capital preservation and steady, compounding performance.

Looking ahead to the next year, our focus remains on strengthening operational resilience, maintaining transparent reporting, and expanding multi-venue coverage to further optimize net carry for all tETH holders.

tETH’s first year has set a strong foundation for what lies ahead. Together, we continue building the fixed income layer of DeFi—one that is stable, efficient, and open to all.

Legal Disclaimer

This report is for informational purposes only. It does not constitute investment advice, financial advice, legal advice, tax advice, or an offer or solicitation to buy or sell any asset or strategy.

High-Risk Warning: Investing in digital assets, including those discussed herein, is highly speculative and involves substantial risk. These risks include, but are not limited to, high market volatility, potential loss of principal, smart contract vulnerabilities, protocol failures, regulatory uncertainty, and liquidity risks.

No Guarantees: All information is provided “as is” without warranty of any kind. While we strive for accuracy, we make no representation as to the accuracy, completeness, or timeliness of the information. Past performance is not indicative of future results. Any forward-looking statements or projections are opinions and are subject to change and inherent uncertainties.

Do Your Own Research: Readers should not rely on this report as a substitute for their own research and judgment. You are strongly advised to consult with a qualified financial, legal, and tax professional to assess your own financial situation and risk tolerance before making any investment decisions.

About Treehouse 🌳

Treehouse, a digital assets infrastructure firm and the decentralized arm of the parent company Treehouse Labs, is at the forefront of revolutionizing the decentralized fixed income market. Treehouse Protocol introduces innovative fixed income products and primitives across chains through tAssets, liquid staking tokens that empowers its users to participate in the convergence of on-chain interest rates while retaining the flexibility to engage in DeFi activities.

Treehouse Protocol is also pioneering the Decentralized Offered Rates (DOR) consensus mechanism for benchmark rate setting, enabling a range of fixed income products and primitives into digital assets. Treehouse is dedicated to creating safer and more predictable return alternatives for both individual investors and institutions.

Website: https://treehouse.finance

Discord: https://discord.gg/treehousefi