As Treehouse continues to expand its fixed-income infrastructure, the DAO is proposing its next major step in aligning protocol growth with long-term tokenholder value.

The latest Treehouse Improvement Proposal (TIP) seeks to introduce a TREE Token Buyback Program to allocate 50% of all protocol fees from tETH toward recurring open-market purchases of TREE, the governance and utility token of Treehouse that powers the fixed income ecosystem.

If approved, these buybacks will be held in the DAO’s reserves—reinforcing the connection between adoption, yield generation, and token value.

View TIP 4: Proposal for TREE Token Buybacks with Protocol Revenue on the Treehouse Governance Forum here.

Why Buybacks Matter

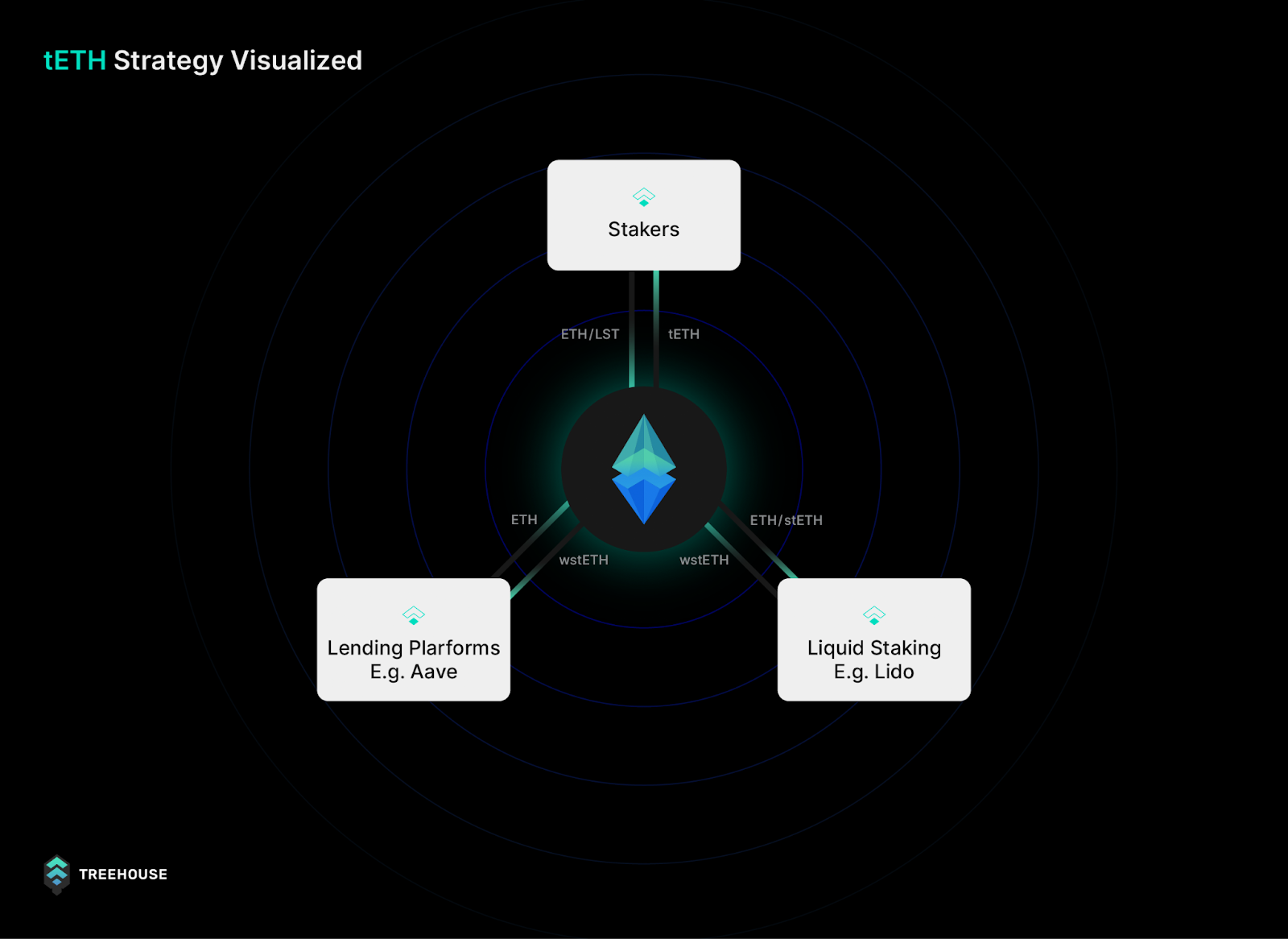

Treehouse generates additional yield on top of native staking yield through the Market Efficiency Yield (MEY) of its tAssets—an interest rate arbitrage strategy designed to give users an additional pickup (MEY) by capturing the difference between Proof-of-Stake (POS) staking yield and borrowing rates in DeFi across lending platforms such as Aave and Spark.

This process unifies fragmented on-chain interest rates, reducing rate volatility while enabling users to benefit from the arbitrage strategy typically accessible only to institutional market makers. Learn more about the Market Efficiency Yield strategy here.

The protocol collects a 20% fee on the Market Efficiency Yield (MEY) generated from tAssets, forming a recurring and sustainable revenue stream for the protocol that scales directly with tAsset adoption.

Under TIP 4, half of the collected fees from the first tAsset, tETH would be directed toward acquiring TREE on the open market.

This seeks to achieve three key outcomes:

- Aligns Token Value with Growth: As adoption and MEY revenue scale, buyback volume increases proportionally.

- Reduces Circulating Supply: Purchased TREE will be held in DAO reserves, tightening supply over time.

- Builds Treasury Resilience: Accumulated TREE can later be used to fund incentives, grants, or other DAO-approved initiatives.

Together, these effects create a self-reinforcing loop, the more Treehouse grows, the stronger TREE becomes, paving sustainable value for both Treehouse and its users.

How the Buybacks Work

The proposed buyback framework is designed to strengthen the long-term health of the Treehouse ecosystem while maintaining operational transparency and flexibility.

By directing a portion of protocol revenue toward open-market TREE purchases, the DAO can steadily accumulate reserves, reduce circulating supply, and create a direct link between protocol growth and tokenholder value.

Allocation Ratio:

50% of all protocol fees generated from the Market Efficiency Yield (MEY) of tETH will be allocated to the buyback program. This ensures that token value capture scales proportionally with protocol adoption.

Mechanism:

Buybacks will be executed on Ethereum via the designated buyback wallet address. This ensures that purchases occur transparently and fairly in open markets, on-chain.

Frequency:

To mitigate front-running and market distortion, buybacks will occur at irregular intervals, with a minimum cadence of once per week. This flexible schedule helps preserve the integrity of the program while maintaining steady accumulation over time.

Destination:

All repurchased tokens will be held under DAO reserves on the buyback wallet. Future deployment, whether for incentives, ecosystem growth, or staking programs, will require separate community approval.

This ensures the system remains flexible and transparent, while allowing the DAO to adapt to evolving market and protocol conditions.

Transparency and Reporting

Transparency is central to Treehouse governance.

To uphold accountability, the DAO will:

- Publish on-chain tracking of buybacks executed with the buyback wallet address.

- Provide periodic updates detailing the size, frequency, cumulative tokens acquired and impact of buybacks

These measures ensure every community member can verify how protocol revenue is being reinvested to strengthen the ecosystem.

The Road Ahead

TIP 4 marks a pivotal step in Treehouse’s journey toward a self-sustaining, value-accruing ecosystem. By linking protocol performance directly to TREE, the DAO strengthens the alignment between builders, users, and tokenholders, ensuring that as the protocol grows, so does the value of participation.

As Treehouse continues to expand its fixed income infrastructure across chains and markets, every new tAsset, integration, and yield source strengthens this feedback loop.

The proposal is now open for discussion in the Governance Forum. After community feedback, it will move to the Snapshot Voting stage for formal approval.

By aligning protocol revenue with TREE buybacks, Treehouse moves closer to realizing its vision of a decentralized, community-governed fixed-income layer for DeFi—one where every participant, from users to builders, contributes to and benefits from the growth of the ecosystem.

The roots of Treehouse continue to deepen, and with it, a brighter, more resilient future for all who call the forest home.

About Treehouse 🌳

Treehouse, a digital assets infrastructure firm and the decentralized arm of the parent company Treehouse Labs, is at the forefront of revolutionizing the decentralized fixed income market. Treehouse Protocol introduces innovative fixed income products and primitives across chains through tAssets, liquid staking tokens that empower its users to participate in the convergence of on-chain interest rates while retaining the flexibility to engage in DeFi activities.

Treehouse Protocol is also pioneering the Decentralized Offered Rates (DOR) consensus mechanism for benchmark rate setting, enabling a range of fixed income products and primitives into digital assets. Treehouse is dedicated to creating safer and more predictable return alternatives for both individual investors and institutions.

Website: https://treehouse.finance

Discord: https://discord.gg/treehousefi